카카오뱅크 마이너스 통장 개설 카카오뱅크 마이너스 통장 개설

No language detected.

Please check the input language, no language detected.

Please check the input language.

Open Kakao Bank Negative Account Open Kakao Bank Negative Account Open now! m.site.naver.com Open Kakao Bank Negative Account Open Kakao Bank Negative Account Open now! m.site.naver.com

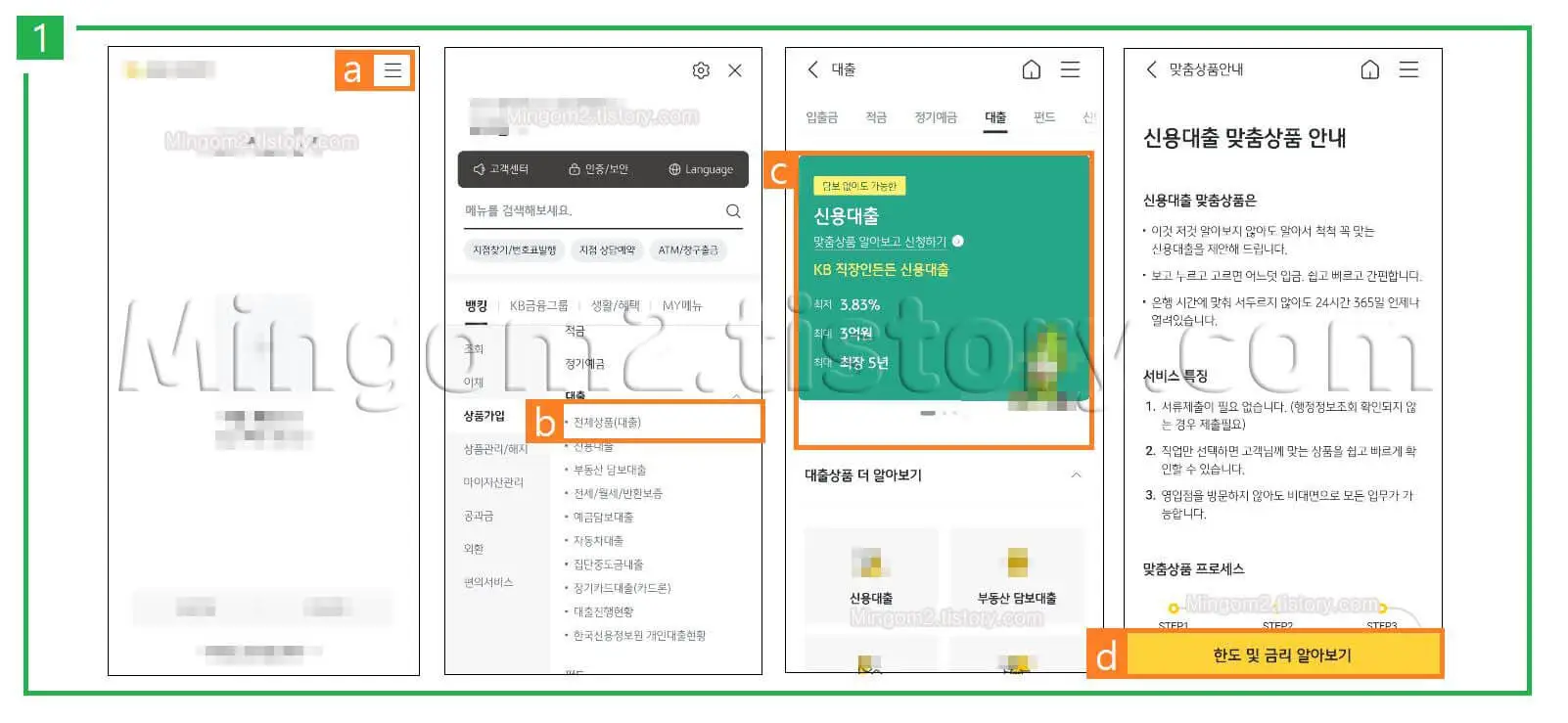

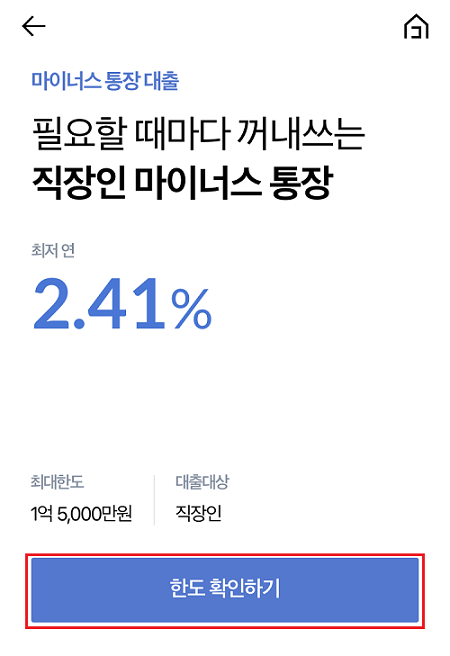

Kakao Bank’s minus account is a financial product that can be used useful when sudden funds are needed. Negative accounts have the advantage of being able to use them fluidly only when necessary because interest is generated only on the amount used after withdrawing as much funds as necessary. 1. Kakao Bank Negative Account Application Condition Kakao Bank Negative Account is for office workers and self-employed people, and in order to apply for a loan, you need to be qualified for at least one year in office and an annual income of at least 35 million won. In addition, income certificate documents such as health insurance qualification loss confirmation and insurance premium payment confirmation are required. Applications can be easily made through the Kakao Bank app, and applications can be made on weekends and holidays. 2. The maximum limit of the limit and interest rate Kakao Bank minus account is 240 million won, and the minimum limit is more than 1 million won. Interest rates start at 5.915% Developed within 7.639%, this may vary depending on the applicant’s credit standing. In addition, interest rates change based on three months or one year of financial bonds, and interest rates change every three months or one year depending on the selected criteria. 3. Interest and precautions in case of delinquency Kakao Bank minus account only generates interest on the amount used. There is no interest on unused amounts, so you can manage your funds in a fluid manner. However, if a delinquency occurs, the overdue interest rate will be applied. Delinquent interest rates can be imposed up to **15%**, and be careful because additional overdue interest may occur on the balance of the loan if you do not repay it for more than a month after the overdue interest occurs. 4. The loan period for the extension and management method minus account is one year, and if necessary, it can be extended on a one-year basis through an application for extension. You will receive an extension notice 45 days before the expiration of the loan, and you can easily apply for an extension through the app. In the case of extension, interest rates may change depending on the credit status, and if the credit score improves, they can be extended to lower interest rates through the right to demand a rate cut. In conclusion, Kakao Bank’s minus account is a very convenient financial product that can be used in a liquid manner when funds are needed. The application process is simple, and interest rates and limit conditions are set relatively advantageously, making it a good choice for office workers and self-employed people. However, it is important to pay attention to interest and overdue payments and to use them systematically as much as necessary. Click > Kakao Bank Negative Account Review Kakao Bank Negative Account is a financial product that can be used useful when sudden funds are needed. Negative accounts have the advantage of being able to use them fluidly only when necessary because interest is generated only on the amount used after withdrawing as much funds as necessary. 1. Kakao Bank Negative Account Application Condition Kakao Bank Negative Account is for office workers and self-employed people, and in order to apply for a loan, you need to be qualified for at least one year in office and an annual income of at least 35 million won. In addition, income certificate documents such as health insurance qualification loss confirmation and insurance premium payment confirmation are required. Applications can be easily made through the Kakao Bank app, and applications can be made on weekends and holidays. 2. The maximum limit of the limit and interest rate Kakao Bank minus account is 240 million won, and the minimum limit is more than 1 million won. Interest rates start at 5.915% Developed within 7.639%, this may vary depending on the applicant’s credit standing. In addition, interest rates change based on three months or one year of financial bonds, and interest rates change every three months or one year depending on the selected criteria. 3. Interest and precautions in case of delinquency Kakao Bank minus account only generates interest on the amount used. There is no interest on unused amounts, so you can manage your funds in a fluid manner. However, if a delinquency occurs, the overdue interest rate will be applied. Delinquent interest rates can be imposed up to **15%**, and be careful because additional overdue interest may occur on the balance of the loan if you do not repay it for more than a month after the overdue interest occurs. 4. The loan period for the extension and management method minus account is one year, and if necessary, it can be extended on a one-year basis through an application for extension. You will receive an extension notice 45 days before the expiration of the loan, and you can easily apply for an extension through the app. In the case of extension, interest rates may change depending on the credit status, and if the credit score improves, they can be extended to lower interest rates through the right to demand a rate cut. In conclusion, Kakao Bank’s minus account is a very convenient financial product that can be used in a liquid manner when funds are needed. The application process is simple, and interest rates and limit conditions are set relatively advantageously, making it a good choice for office workers and self-employed people. However, it is important to pay attention to interest and overdue payments and to use them systematically as much as necessary. Click > Kakao Bank Negative Account Review

Previous image Next image Previous image Next image

Kakao Bank minus account Kakao Bank minus account Kakao Bank minus account Kakao Bank minus account Kakao Bank minus account Kakao Bank minus account Kakao Bank minus account Kakao Bank minus account Kakao Bank minus account Kakao Bank minus account